Brief overview

We offer our clients the opportunity to significantly simplify collaboration in upstream and downstream payroll activities by using digital processes.

For the notification of changes, e.g. in the master data or the salaries of individual employees, we offer you input tools via which we transfer the changes directly into our payroll program.

You can make all entries and changes anywhere and with all end devices. Other documents such as employment contracts or enrollment certificates can be stored in the digital personnel file. The monthly wage and salary evaluations are also available there at any time.

Advantages of digital payroll accounting

An overview of our services

Your request is not listed? No problem, because our range of services includes numerous other points and areas. Contact us with your request and we will surely find your very individual solution.

Digital collaboration for payroll

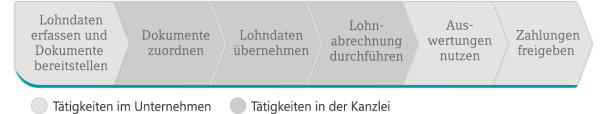

See how you can exchange wage data and documents digitally with your tax advisor using DATEV Unternehmen online:

Record wage data and provide documents

With the preliminary wage recording online you record the wage data (master and transaction data) in a structured way in the company. A plausibility check helps to avoid input errors. You can transfer the recorded data to your DATEV payroll program via the DATEV Cloud.

You transmit documents such as employment contracts or enrollment certificates to the office online using the Digital Personnel File in Vouchers.

Assign documents and transfer wage data

In this way, the office receives all data and documents relevant to payroll. In addition, the office can assign the documents to your employee or to you as a mandate and transfer the data to the payroll programs.

Perform payroll accounting and use evaluations

After payroll accounting, the firm provides you with all the important evaluations such as the payroll journal or the personnel cost overview of companies online. You can access it at any time and from anywhere. You can see how this works in the video.

Release payments

The office provides the wage payments digitally after the settlement via bank online or payment online and you can release them.

In order to prepare payroll documents, your tax advisor will need many documents from you, such as employment contracts or enrollment certificates. With the Digital Personnel File, you exchange these documents of human resources management, between you and your law firm – easily, quickly and securely.

The digital personnel file in your daily office routine

The documents are stored securely in the DATEV cloud and are thus available at any time in a clear and structured manner. This way, you and your tax advisor have a consistent level of information at all times, which reduces the number of inquiries from both sides. At the same time, you reduce your paper filing system because the documents are in digital form; this saves you printing and storage costs. The DATEV cloud ensures high security standards.

Record wage data and provide documents

With the preliminary wage recording online you record the wage data (master and transaction data) in a structured way in the company. A plausibility check helps to avoid input errors. You can transfer the recorded data to your DATEV payroll program via the DATEV Cloud.

In this way, the office receives all data and documents relevant to payroll. In addition, the office can assign the documents to your employee or to you as a mandate and transfer the data to the payroll programs.

Perform payroll accounting and use evaluations

After payroll accounting, the firm provides you with all the important evaluations such as the payroll journal or the personnel cost overview of companies online. You can access it at any time and from anywhere.

Structure, content, design and delivery options – The gross/net statement offers you more than just a listing of monthly pay.